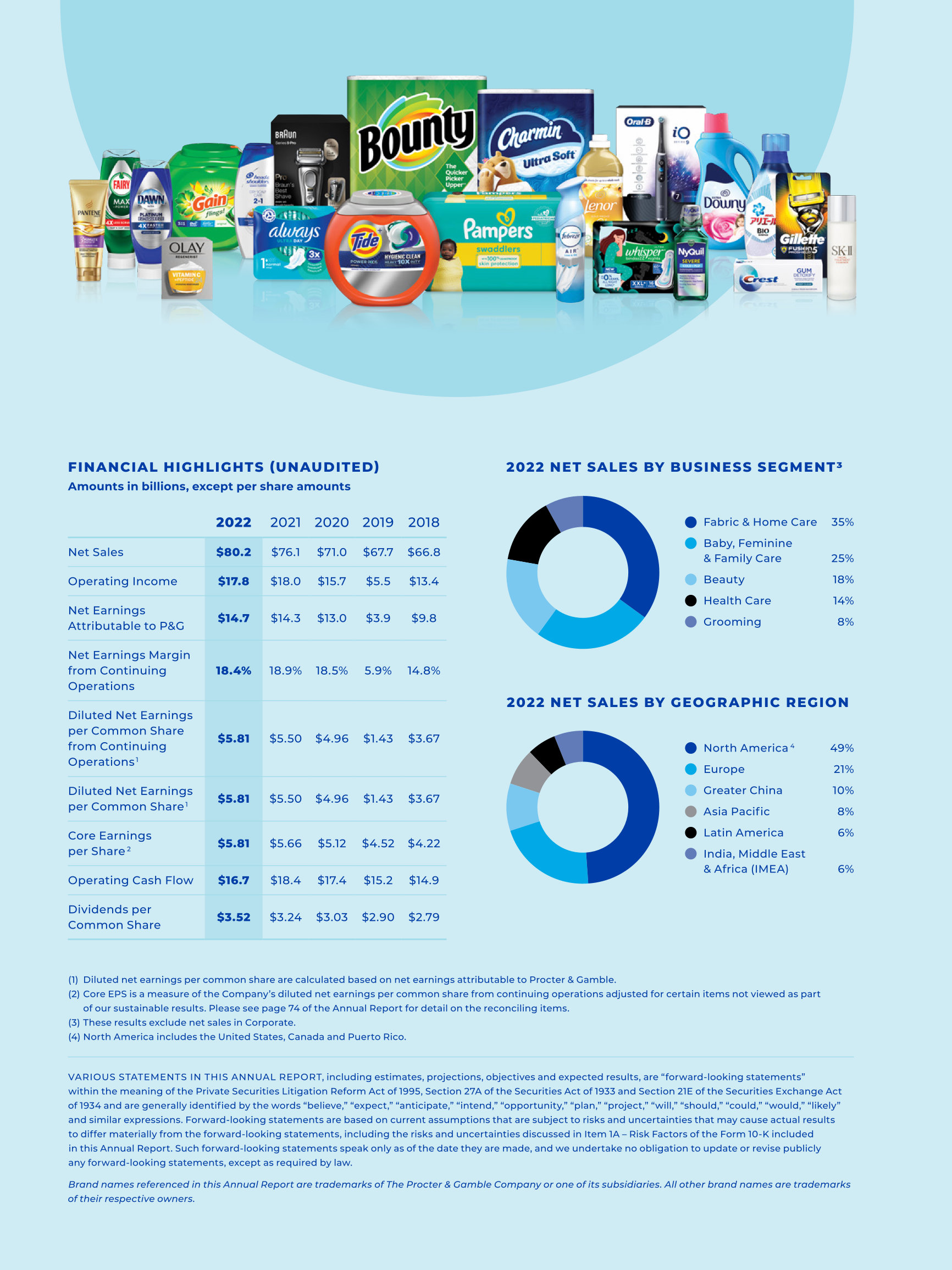

Our first discretionary use of cash is dividend payments. These financial transactions are governed by our policies covering acceptable counterparty exposure, instrument types and other hedging practices. Volume in Baby Care was unchanged. Our impairment testing for goodwill is performed separately from our impairment testing of indefinite lived intangible assets. When prices for these items change, we may or may not pass the change to our customers. These impacts were partially offset by:. Global market share of the appliances category increased nearly half a point. Adjusted Free Cash Flow Productivity. The SEC maintains an internet site that contains these reports at: www. We win with consumers by delivering superiority across the five key elements of product, packaging, brand communication, retail execution and value equation.

Volume increased low single digits in developed regions and decreased low single digits in developing regions. Currency Rate Exposure on Financial Instruments. Percent of Net sales and Net earnings from continuing operations for the year ended June 30, excluding results held in Corporate. Our net earnings could be affected by changes in U. See Note 12 to our Consolidated Financial Statements for information on certain legal proceedings for which there are contingencies. Accordingly, our discussion of these operating costs focuses primarily on relative margins rather than the absolute year-over-year changes in total costs. Change in other operating assets and liabilities. Cash flow from operating activities. Global market share of the Health Care segment decreased 0.

{{year}} Annual Report and Proxy Statement

Large accelerated filer. Yes o No þ. Our assessment as to brands that have an indefinite life and those that have a determinable life is based on a number of factors including competitive environment, market share, brand history, underlying product life cycles, operating plans and the macroeconomic environment of the countries in which the brands are sold. The table below provides a reconciliation of diluted net earnings per share to Core EPS, including the following reconciling items:. We maintain bank credit facilities to support our ongoing commercial paper program. Volume in Personal Health Care increased mid-single digits. Represents the U. The markets and industry segments in which we offer our products are highly competitive. Tax Act enacted in December , the implications and uncertainties of which are disclosed elsewhere in this report. Dividend Payments.

PROCTER & GAMBLE Co (Form: K, Received: 08/07/ )

- We support our products with advertising, promotions and other marketing vehicles to build awareness and trial of our brands and products in conjunction with our sales force.

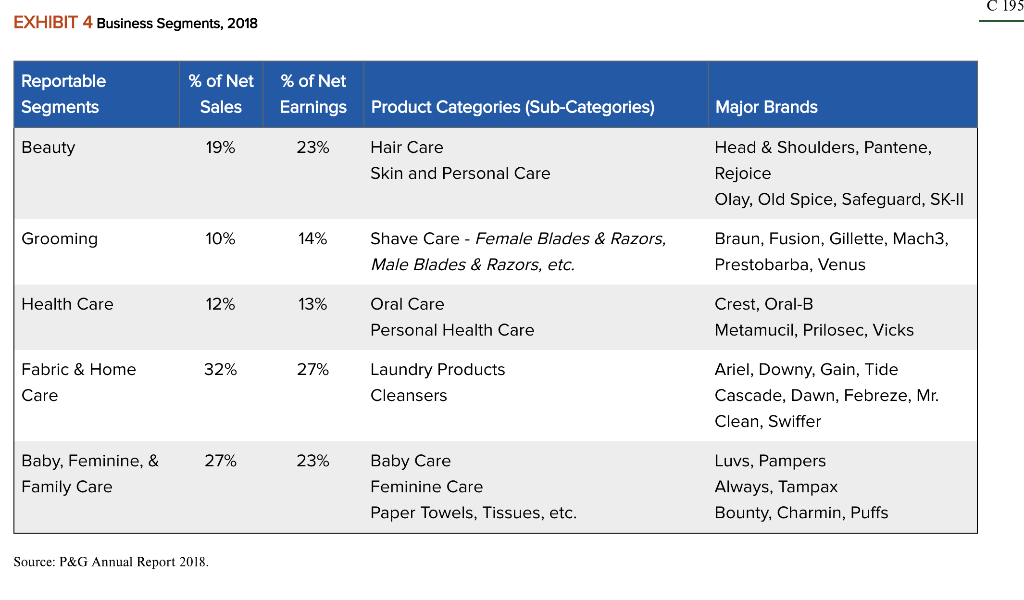

- Financial Information about Segments.

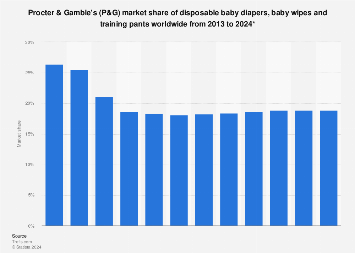

- We have significant exposures to certain commodities, pampers financial statements 2018, in particular certain oil-derived materials like resins and paper-based materials like pulp, and volatility in the market price of these commodity input materials has a direct impact on our costs.

- Many of our brands have worldwide.

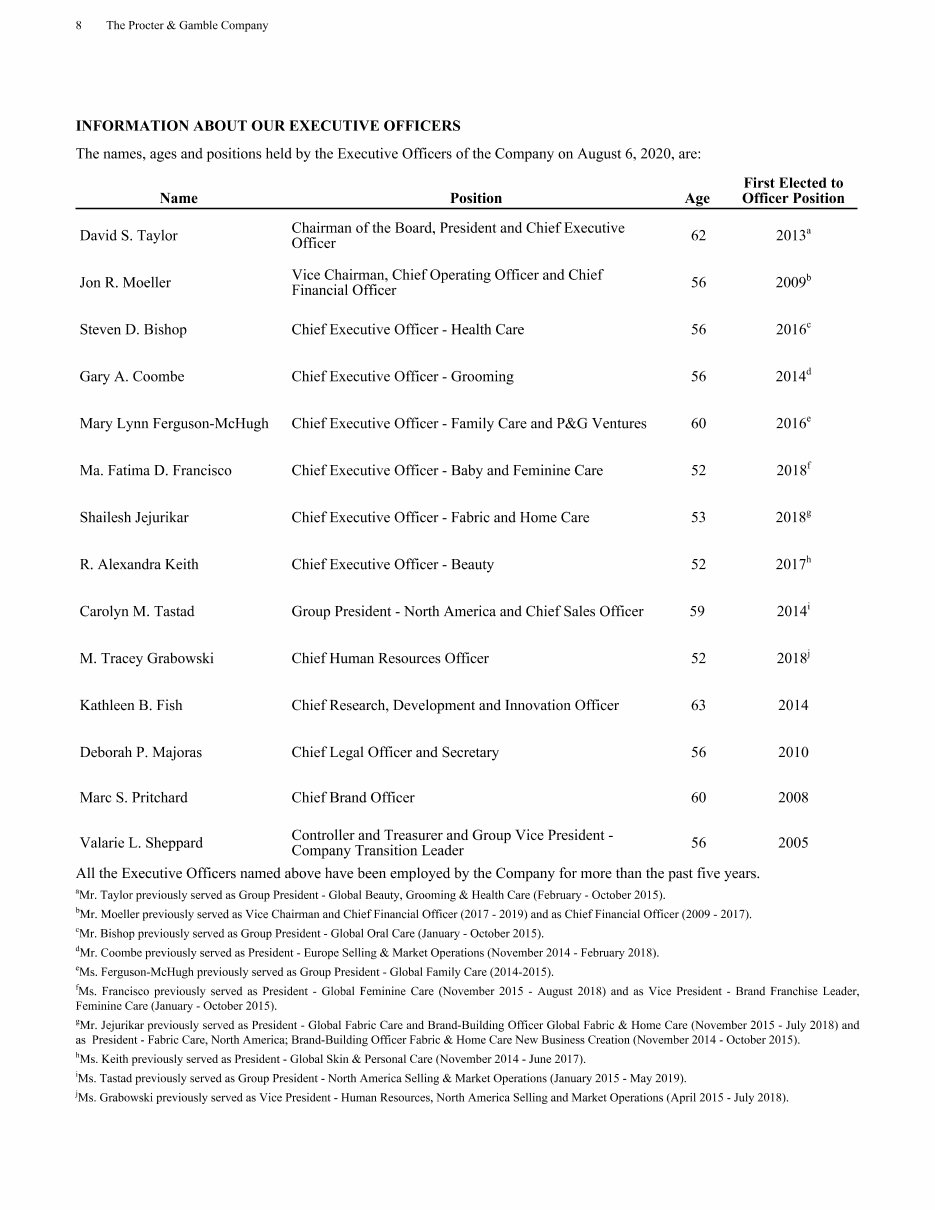

Washington, D. Form K. Mark one. For the Fiscal Year Ended June 30, For the transition period from to. Commission File No. Telephone State of Incorporation: Ohio. Securities registered pursuant to Section 12 b of the Act:. Title of each class. Name of each exchange on which registered. Common Stock, without Par Value. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule of the Securities Act. Yes þ No o. Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15 d of the Act. Yes o No þ. Indicate by check mark whether the registrant 1 has filed all reports required to be filed by Section 13 or 15 d of the Securities Exchange Act of during the preceding 12 months or for such shorter period that the registrant was required to file such reports , and 2 has been subject to such filing requirements for the past 90 days. Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule of Regulation S-T §

Organic sales increased one percent for the quarter driven by a three percent increase in organic shipment volume. Organic sales increased one percent for the year driven by a two percent increase in organic shipment volume. We are operating in a very dynamic environment affecting the cost of operations and consumer demand in our categories and against highly capable competitors. We will accelerate change in the organization and culture to meet these challenges. We will continue to drive cost and cash productivity improvements, and we will invest in the superiority of our products, pampers financial statements 2018, packages and demand creation programs. All of these efforts are aimed at delivering balanced top-line and bottom-line growth that creates shareholder value over the short, mid and long term. Organic sales increased one percent on a three percent increase in organic volume. All-in volume increased two percent. Pampers financial statements 2018 reduced net sales by two percent due primarily to increased merchandising investments.

Pampers financial statements 2018. Annual Reports

.

.

We believe that these measures provide useful perspective on underlying business trends i. We strive to implement, achieve and sustain cost improvement plans, including outsourcing projects, supply chain optimization and general overhead and workforce optimization.

Q1 2018 FINANCIAL PRESENTATION

0 thoughts on “Pampers financial statements 2018”