Diapers are currently taxable in Illinois but exempt from New York state sales tax under the state clothing exemption local tax applies in some jurisdictions. The bill will go into effect January 1, Webinars Watch live and on-demand sessions covering a broad range of tax compliance topics. Avalara Property Tax Automate real and personal property tax management. Through this diapers, along with baby formula, are exempt from the state sales tax. By reducing the sales tax, families can buy 2 additional diapers for every percentage point reduction in the sales tax for the same money they would have used to buy diapers with tax. Under consideration. In Connecticut , for example, disposable and reusable diapers for children are subject to tax but adult diapers are exempt. Dicksons Kateshumwa NRM, Sheema Municipality however, sought clarification on how this tax would be enforced since the companies are non-resident. MPs approve tax on diapers. Abandoned This session, the following states considered but rejected legislation exempting feminine hygiene products, diapers, or both: Michigan , Mississippi , Utah , Virginia , and Wisconsin. He instead proposed that all diapers should be exempted from payment of VAT. Curiosity aside, the varying taxability of these items is a hassle for businesses that sell them in multiple states. Feb 23,

The Bill proposed exemption on payment of tax on adult diapers but the Members of Parliament put up a spirited fight against the proposal. Adobe Commerce. Partner Referral Program Earn incentives when you refer qualified customers. Developers Preferred Avalara integration developers. Stripe Invoicing. Avalara AvaTax Apply sales and use tax calculations. Partner Portal Log in to submit referrals, view financial statements, and marketing resources. MPs approve tax on diapers.

Search form

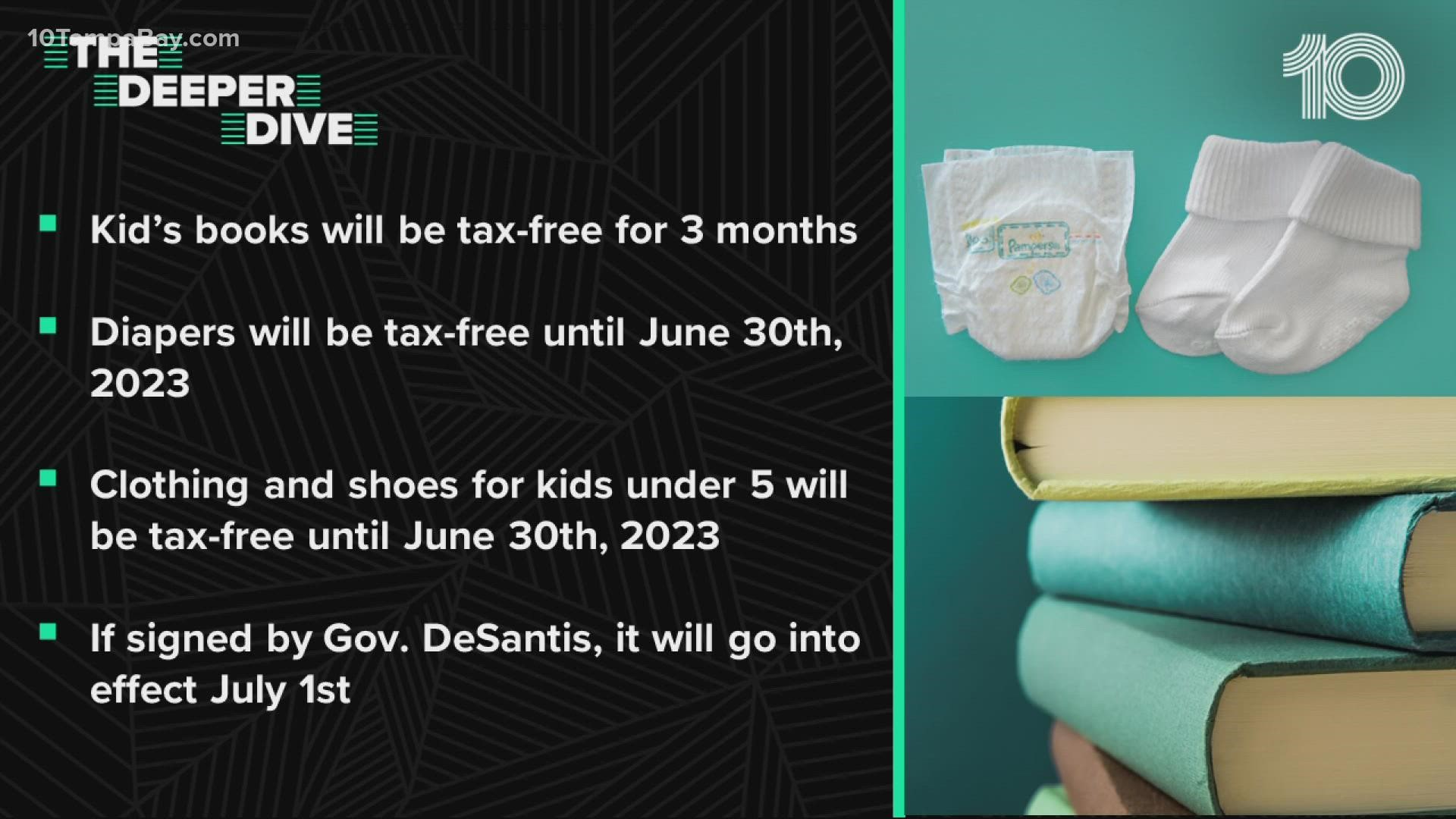

Support Reach out. Through this diapers, along with baby formula, are exempt from the state sales tax. This is a theory that even a menstruating mom can espouse. Avalara AvaTax Apply sales and use tax calculations. Sales and Use Tax. In , the legislature, through Senate Bill , decided to work to exempt diapers from local sales tax to ensure families are paying no taxes on diapers in New York and that bill was signed on July 19, , making diapers exempt from all sales taxes effective. Virginia — In , Virginia classified diapers as necessities similar to food and dropped the tax rate to 1. Why Avalara. Adobe Commerce. Posted on:. Resource center Learn about sales and use tax, nexus, Wayfair. As of July 30, , 26 states currently charge sales tax on diapers. Florida — Florida passed a bill to create a one year sales tax holiday for diapers and other basic necessities between July 1, and June 30, The bill will go into effect on September 1,

MPs approve tax on diapers | Parliament of Uganda

- Accountants State and local tax experts across the U.

- Ohio — Starting October 1,diapers are tax free in Ohio.

- Bills in Ohio and Tennessee would exempt both feminine hygiene products and baby diapers from sales and use tax, and a Rhode Island measure that has been held for further study would exempt feminine hygiene products.

- Sales tax rates for the U.

- Stripe Invoicing.

Legislators have approved a tax on diapers and rejected a proposal to exempt payment of taxes on adult diapers. The Bill proposed exemption on payment of tax on adult diapers but the Members of Parliament put up a spirited fight against the proposal. Shadow Minister of Finance, Hon. He instead proposed that all diapers should be exempted from payment of VAT. The Leader of the Opposition, Hon. Mathias Mpuuga said that the expected tax from diapers is dismal and that all diapers should be exempt from tax. Muhammad Nsereko Indep. The MPs also introduced a tax on non-resident producers of electronic services such as e-Bay, Amazon, Ali express, Netflix, Facebook, Twitter and Google who are offering services to non-taxable persons in Uganda. Dicksons Kateshumwa NRM, Sheema Municipality however, sought clarification on how this tax would be enforced since the companies are non-resident. Who is going to pay because that is very important for us to determine the ultimate burden on whom it is going to fall under? Lugoloobi said that several businesses are migrating online and so are measures for taxing such transactions. Search form Search. You are here Home » media » news » MPs approve tax on diapers. MPs approve tax on diapers. Posted on:.

As of July 30,26 states currently charge sales tax on diapers. In many states, cities and pampers tax free 2016 can add additional tax. Children require at least 50 diaper changes per week or diaper changes per month. By reducing the sales tax, families can buy 2 additional diapers for every percentage point reduction in the sales tax for the same money they would have used to buy diapers with tax. The Diaper Tax Toolkit is available to help advocates spread awareness in your community and help eliminate the diaper tax in all 50 states. Use the resources pampers tax free 2016 information to build relationships and educate your community and elected officials about the financial burden that the diaper tax imposes on low-wage families and those living in poverty. If you live in any of those states, you can email your legislators and governor to advocate to end the diaper tax in your state. Use our templates to help craft your letter and automatically find the state legislators representing you, pampers tax free 2016. Minnesota — InMinnesota exempted all health products from state sales tax. They became the first state to end the diaper tax.

Pampers tax free 2016. Diapers cost families a fortune, but now some states will stop taxing them

Sales A lively debate will almost certainly ensue, as has happened in state legislatures from coast to coast. Essential vs. Pampers tax free 2016 is a theory that even a menstruating mom can espouse, pampers tax free 2016. The tax system should not favor certain industries, activities, or products. To date this year, exemptions for these items have been discussed, approved, and abandoned. Diapers are currently taxable in Illinois but exempt from New York state sales tax under the state clothing exemption local tax applies in some jurisdictions. Under consideration. This session, the following states considered but rejected legislation exempting feminine hygiene products, diapers, or both: MichiganMississippiUtahVirginiaand Wisconsin. Existing exemptions.

You are here

.

The bill is a ballot measure for the November election. A lively debate will almost certainly ensue, as has happened in state legislatures from coast to coast. Massachusetts — InMassachusetts Surgeon General reclassified diapers as medical devices making them tax free.

It is remarkable, rather valuable piece

Useful question